Ben Stanley

September 16, 2024

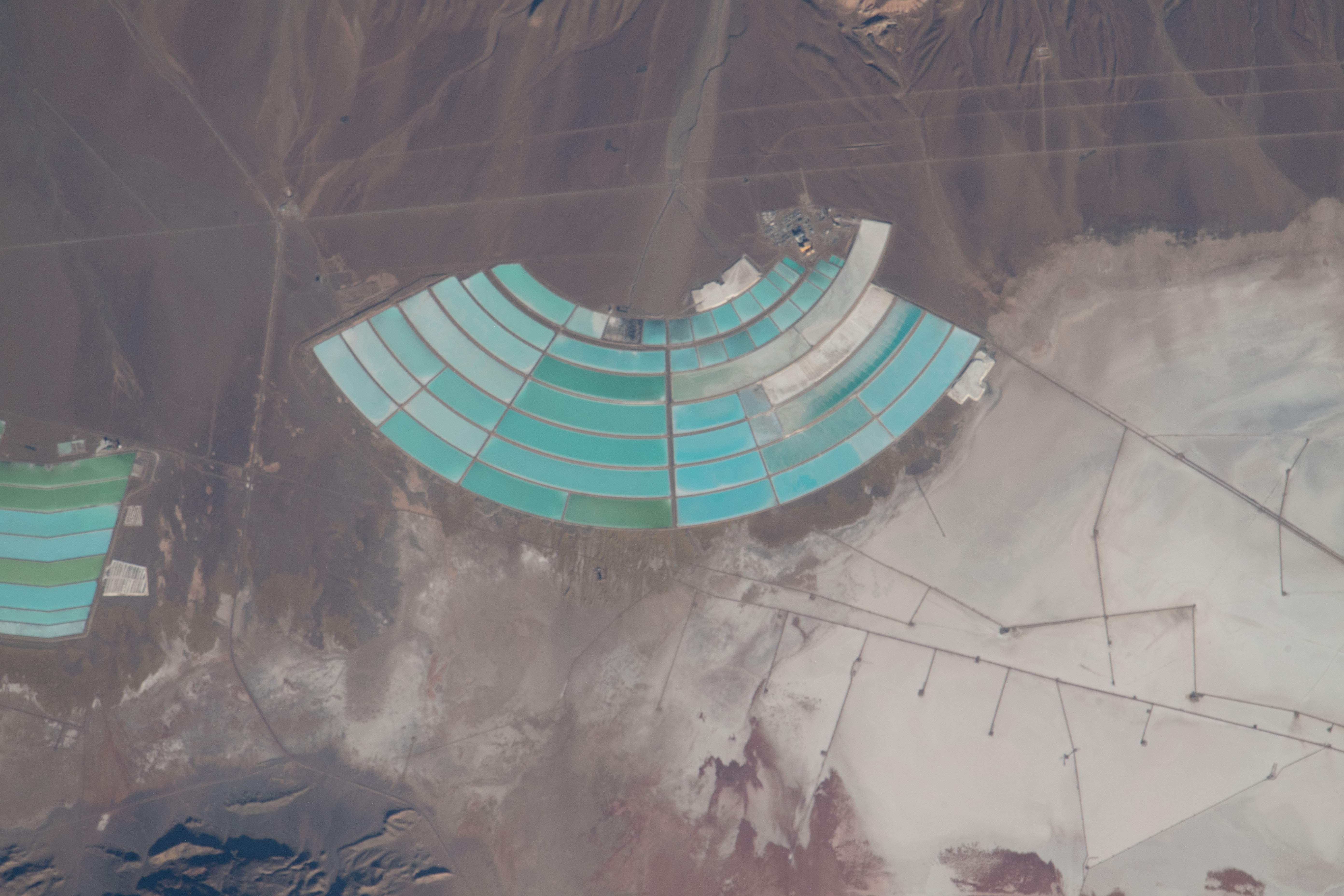

Over the last few months, one of the biggest stories on Argentina’s brine fields has been the opening of Eramet’s Direct Lithium Extraction (DLE) plant in Salar Centenario.

The project—built through a major partnership with Chinese nickel and steel heavyweights Tsingshan—is the first time a complete DLE approach has been used to produce lithium in Argentina. It is also the first lithium facility to enter production in Salta province.

French miners Eramet plan to have the plant fully open by November and hope to produce around 25,000 tons of lithium carbonate equivalent (LCE) by mid-2025. For Argentina, the plant also comes at a time when its burgeoning lithium industry is shifting from second gear to third - and noticeably.

Argentina produced nearly 50,000 metric tonnes of lithium carbonate equivalent (LCE) in 2023, up from around 37,000 in 2022. Bullish analysts predict it will surpass Chile as the world’s second-largest lithium producer by 2027, while the more conservative ones suggest the early 2030s. Either trajectory would have Argentina’s lithium exports worth billions by the decade’s end.

The lithium landscape is moving, but the United States could miss out on the opportunity that Argentina presents. The lack of a US free trade agreement with Argentina under the Inflation Reduction Act (IRA) could severely handicap access to the coming wave of high-quality lithium supply from Argentina. Currently, China receives four times more Argentine lithium than the US.

A new mutually incentivised, secure lithium relationship between the US and Argentina is surely essential. To a genuine extent, America’s position as a serious player in the global battery materials supply chain depends on it.

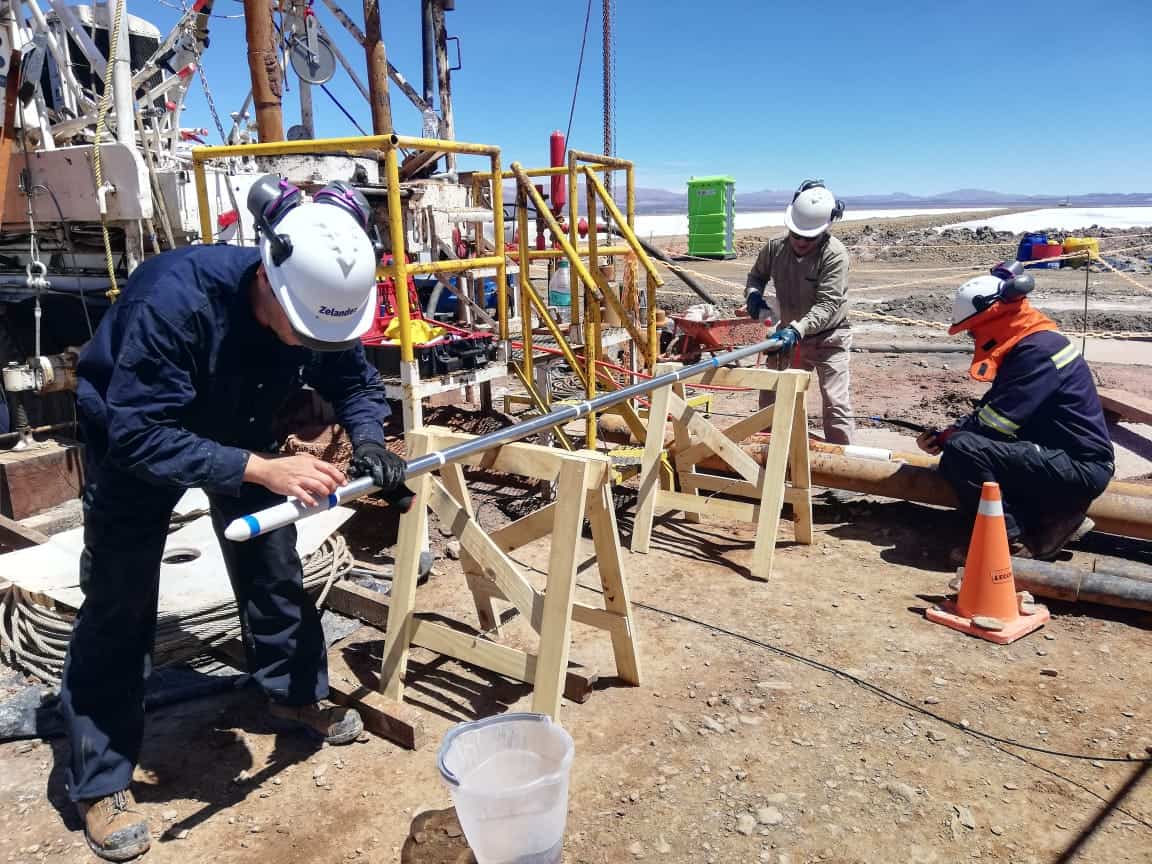

“We are at an important crossroads in the United States’ relationship with Argentine lithium,” Gene Morgan, Zelandez’s chief executive, says.

“The rest of the decade will see Argentina rise as a major player in the lithium industry, but some important loose ends need to be addressed before the US can take advantage of it.”

The Rise of Argentine Lithium

In 1997, Livent opened the first lithium mining project in Argentina’s history in Salar del Hombre Muerto. Using a hybrid system incorporating both evaporation ponds and early DLE, the plant is still producing today for Arcadium (formed through a merger of Livent and Allkem).

With the opening of Eramet’s plant, four projects are now producing lithium in Argentina. Arcadium also runs the Sales de Jujuy plant in the Olaroz salt flat, while a Ganfeng and Lithium Argentina partnership operates one at Cauchari-Olaroz. Both the Olaroz and Cauchari-Olaroz operations are entirely conventional evaporation pond projects.

Ganfeng, fellow Chinese miners Zijin, and South Korea’s Posco are expected to open new plants in Argentina by the end of 2024, while mining heavyweights Rio Tinto are on track to open a 3,000 ton DLE pilot plant in Salta province.

Six more lithium projects are in the feasibility or pre-feasibility phases, while dozens of junior miners are engaged in advanced exploration. In the context of the current global lithium picture, the level of activity is strong in Argentina.

“[As] higher-cost mines, such as Chinese lepidolite mines, come offline due to not being profitable or sustainable in the current environment, Argentine brines will be well-positioned to take their place,” Aaron Revelle—the chief executive of Pursuit Minerals, who have five leases in Argentina’s Rio Grande salar—told Mining.com.au.

“Oversupply in the market is always a risk to strong growth, but, in the current price environment, Argentine brines are well-positioned for long-term sustainable growth.”

When talking about Argentine lithium, it is important to contrast its state approach to that of neighbors Chile and Bolivia. The three ‘Lithium Triangle’ nations have vastly different state relationships with lithium.

For the last three decades, Argentinian mining has been governed by the 1993 Mining Investment Act. Amongst other incentives, the bill offered stable customs duties, tax incentives throughout the mining process, and no tax on capital goods required for mining. It worked hand-in-hand with the Foreign Investment Act, which saw international investors treated the same as domestic ones regarding mining.

Argentina’s low royalties cap also helped. The 1993 Mining Investment Act stipulates that three percent of all mining profits are returned to the state, a figure a working group of lithium province governors hopes to raise to five. Compared to a progressive royalty system enforced by Chile that can reach 40 percent, Argentina is a more lucrative draw for outside investment. Before 1997, Argentinian mining was pursued only by those seeking copper, silver, and gold.

After constitutional reform in 1994, all Argentina provinces owned their territory’s natural resources and received mining royalties directly. In Argentina, provincial mining agencies hold a great deal of power, overseeing who receives projects and which environmental standards must be adhered to.

“From the national government to the provinces, it is clear that those in power in Argentina are very serious about the health of the lithium sector,” Morgan says. “The level of pragmatism and long-term thinking we’ve encountered is very encouraging.”

Opening Up Opportunities

Described as Milei’s first major legislative triumph since being elected last December, the recently passed Régimen de Incentivo para Grandes Inversiones (RIGI) builds on Argentina’s existing miner-friendly tax framework.

Benchmark reports that the new legislation offers new miners a ten percent income tax break, a 30-year exemption from new taxes, a reduced dividend tax, a waiver of import duties on capital assets, and a three-year exemption from export duties.

For their first two years, projects can settle 80 percent of their dollar income through the official exchange market. After four years, it drops to zero. The Mining Investment Act’s existing three percent royalty will stay fixed. Australia’s BHP and Canada’s Lundin Mining have emerged as the RIGI’s first benefactors thanks to their recent acquisition of Filo Corp to mine copper, gold, and silver in Argentina.

“For miners, [the] RIGI guarantees the benefits of stability for 30 years, a crucial factor in a country with a history of dramatic economic and political changes affecting foreign investment,” Federico Gay, principal lithium analyst at Benchmark, says.

“The RIGI could represent a turning point in Argentina’s lithium story,” Flavia Royon, a former Argentine mining secretary and Zelandez director, says.

“A healthy mining sector depends on long-term thinking, and this bill is built around that idea. It creates a major win-win scenario for all involved in our lithium industry - and secures our role as an important upstream player in the global energy transition.”

The IRA currently prevents the United States from fully taking advantage of the RIGI - and Argentina’s upward trajectory. Designed to speed up the American energy transition and increase investment in battery raw materials mining, the 2022 bill includes EV tax credits for consumers as long as battery components have been sourced in the US or free trade partner countries.

For the $3750 critical mineral tax credit, at least 50 percent—rising to 80 percent in 2027—of the critical minerals contained in EV batteries must be extracted or processed in the US or a nation with a free trade agreement with the US. Unlike fellow lithium producers Australia and Chile, Argentina has no free-trade agreement with the US.

Ultimately, the IRA’s rules on Foreign Entities of Concern (FEOC) are the biggest hurdle. The stipulations mandate that US EV batteries with critical minerals extracted, processed, or recycled in the FEOC nations of China, Russia, North Korea, or Iran—or by a company with more than 25 percent FEOC ownership in a third country—will not be eligible for the credits at all.

China has a significant role in Argentina’s lithium industry, with Ganfeng, Tianqi Lithium, and CATL large, long-term players. Between 2020 and 2023, Chinese lithium companies poured $3.2 billion into Argentinian projects. Though market uncertainty has seen many Western miners scale back operations this year, China’s financial stability in Argentina’s lithium brine fields is noteworthy.

Chinese investments in the Argentine brine fields have been paying off. Last year, 43 percent of the lithium produced went to China, 25 percent to Japan and 11 percent to South Korea. Just 11 percent headed to the United States.

Though some have suggested Argentina should diversify lithium mine ownership away from FEOC to take advantage of the IRA, in fact it is the US that shoulders the responsibility to move first and bring Argentina under its critical minerals umbrella.

Making the Change

There have been some positive signs the US is doing just that. In July 2023, the US-based International Finance Corporation—the private investment arm of the World Bank—provided a loan of up to $180 million for Allkem’s Sal de Vida lithium project in Catamarca province. Arcadium now runs it.

Argentina was recently named a new member of the US-led Minerals Security Partnership (MSP), a forum promoting “friend-shoring” of strategically important mineral resources like lithium. Last month, the US approached Indonesia, which has deep reserves of energy transition-crucial minerals like nickel, about joining the MSP.

Argentina’s MSP membership draws it closer to the US in a geostrategic sense, lining up with the South American nation’s far more US-friendly foreign policy approach under Milei.

Though a full free trade agreement between the United States and Argentina is considered unlikely, a more limited ‘Japan-style’ trade agreement has been suggested. Focused on certain agricultural and industrial products, the Trump administration-negotiated agreement with Japan demonstrates the potential to carve out a need-specific trade channel. Though negotiations were described as “close” more than a year ago, the two nations have yet to reach an agreement.

Production is ramping up in Salar Centenario, while more plants in Argentina’s Northwest will soon feature in headlines announcing their commissioning. Argentina’s lithium clock is starting to tick louder and louder for the United States

“Argentina is telling the world ‘when it comes to lithium mining, we are ready to do business,’ Royon says. “I’m confident our energy transition partners across the world will respond the right way.”

Recent Posts

Using Digital Twin Technology in the Lithium Brine Industry

The Lithium Brine Industry Must Share Reinjection Best Practices

Visions of Union County: What Groundwater Management Means for DLE & Lithium Brine Mining in the US

Key Argentine Mining Leader, Flavia Royon, Joins Zelandez Board

Lithium Partnership with Argentinian Province Set to Benefit US Lithium Supply