Clint Van Marrewijik

August 20, 2024

When we look back in a decade's time, how will we think of the lithium market of today?

I think we’ll remember 2024 as the year that Direct Lithium Extraction (DLE) got its first real road test.

Several DLE projects are now being commissioned— for example Centenario-Ratones, Argentina (Eramet)—with many feasible opportunities to work at scale. DLE plants in South Arkansas and California yield promise, with many more concepts getting closer to the commercial phase.

The shift from evaporation ponds to DLE in South America will immediately create a new problem.

It is a solvable problem—with deep wells of knowledge that are transferable from the Oil & Gas industry—but it is a substantial problem nevertheless:

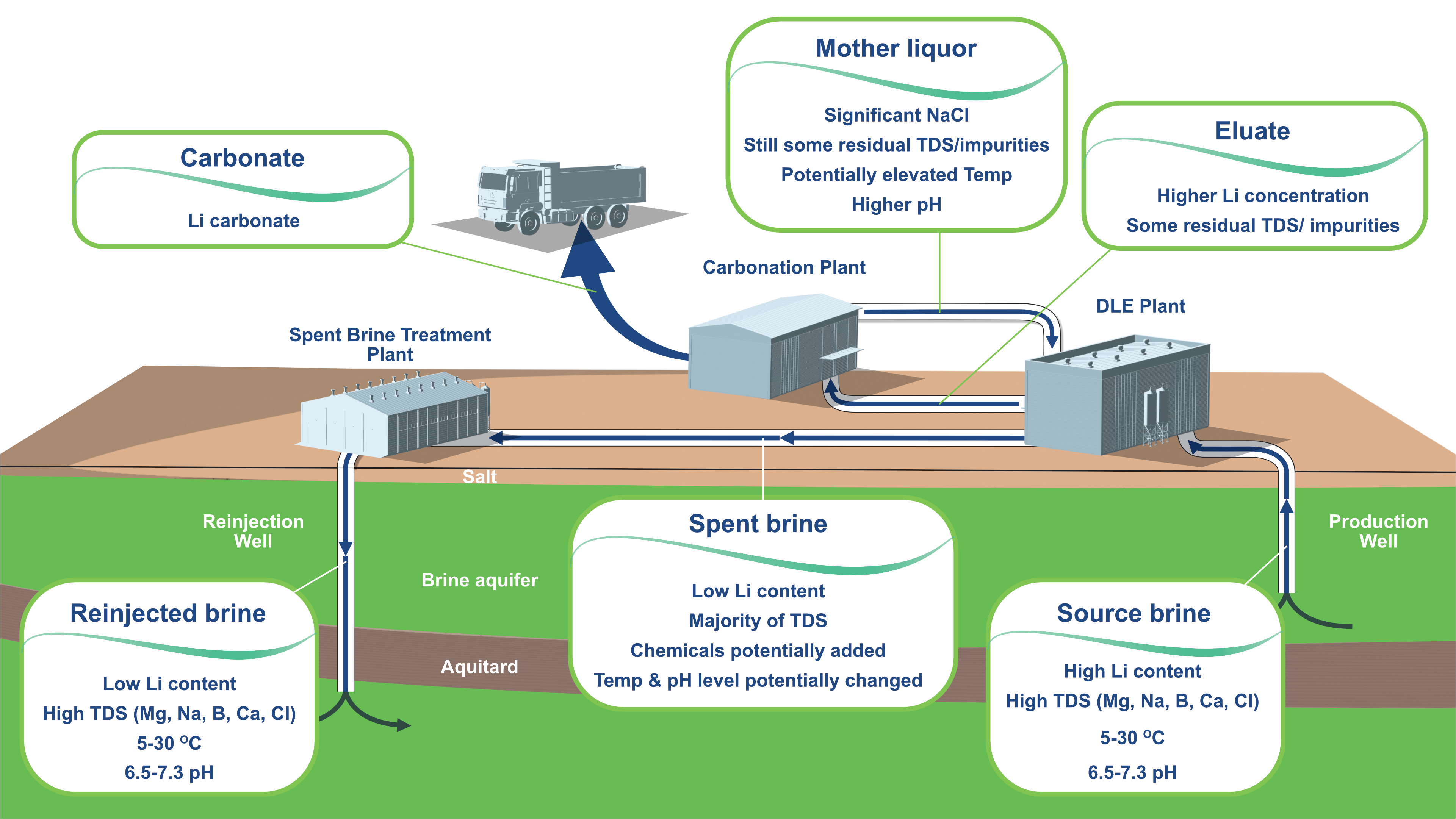

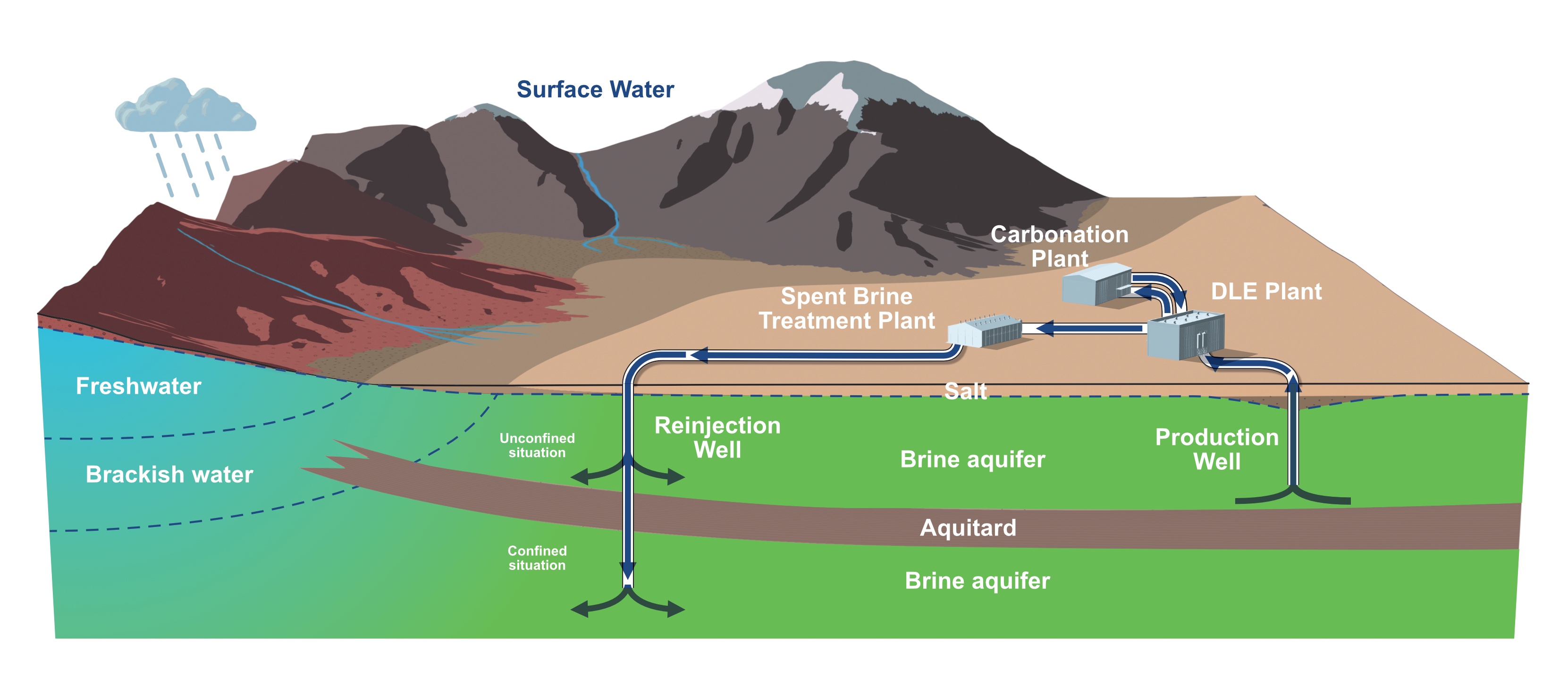

Where does all the liquid go once you’ve extracted the lithium?

The issue of reinjection—or, as we see it, “brine recycling”—is now arguably the number one issue in the lithium brine sectors of Chile, Argentina, and Bolivia.

For many projects it is now the critical path.

At the moment each project is engaging in its brine recycling efforts individually, acting in relative silos. And for the most part the regulators and lawmakers are at sea, without a strong knowledge-base of the best practices. From the provincial to national levels, there is little in the way of frameworks or standards for miners to follow, in order to reinject their spent brine responsibly.

The stakes are high, and we think that the lithium industry should come together and discuss what best practices should be deployed. That’s something that Zelandez is willing to invest in.

This week Zelandez published a white paper, with input from more than a dozen respected industry players, addressing best practices for recycling and reinjecting spent lithium brine. The 80-page document, ‘Recycling Brine for a Greener Future,’ contains what is understood to be the first guidelines for spent lithium brine best practices. Albemarle, SQM, Eramet, Arcadium, and Hatch are among those who have reviewed and had input on the paper.

Although Zelandez has offered a specialized spent brine reinjection service since 2023, this new work collaborating with the industry, has resulted in what we hope is a foundational document. It is something we could not have completed on our own.

What could go wrong?

Let's state the obvious. Poor reinjection technique could damage brine formations and potentially lead to significant financial and environmental repercussions. That's not something we can accept. At the end of the day, good brine recycling must align with the principles of responsible, sustainable resource management.

Progress is already being made:

The incredibly encouraging thing we found as we developed the white paper (alongside the industry) was the learning mindset of the engineers and geoscientists themselves. They are determined to get it right.

Due to the unique makeup of different lithium brine basins, the design of each reinjection process will differ from project to project. So just like DLE, it won’t be a one-size-fits-all approach. But unlike DLE, when it comes to reinjection, we should not keep best practices secret.

Improving the design of well completions, for example, is just one important change that must come in South America. These are the kinds of things we should be thinking about, talking about, and making happen.

To that end, a "brine recycling working group" will be set up—an industry roundtable of sorts. To bring together reinjection practitioners (those people doing the design and engineering). Because as best practice develops, we should aim to share knowledge so that mistakes can be avoided and we can all execute our projects efficiently.

The good news is that the professionals in the lithium brine industry are already taking up the challenge.

The white paper can be found here.

The thanks of Zelandez goes to numerous individual contributors, and to the International Lithium Association and Fastmarkets, along with Summit Nanotech, Albemarle, Arcadium, SQM, Eramet, Hatch, CTR, Power Minerals, Wood, WSP, and Upflow.

Recent Posts

Using Digital Twin Technology in the Lithium Brine Industry

How the Inflation Reduction Act and US Trade Policy Could Handicap Its Ability to Harness Argentine Lithium Supply

Visions of Union County: What Groundwater Management Means for DLE & Lithium Brine Mining in the US

Key Argentine Mining Leader, Flavia Royon, Joins Zelandez Board

Lithium Partnership with Argentinian Province Set to Benefit US Lithium Supply